Valuation

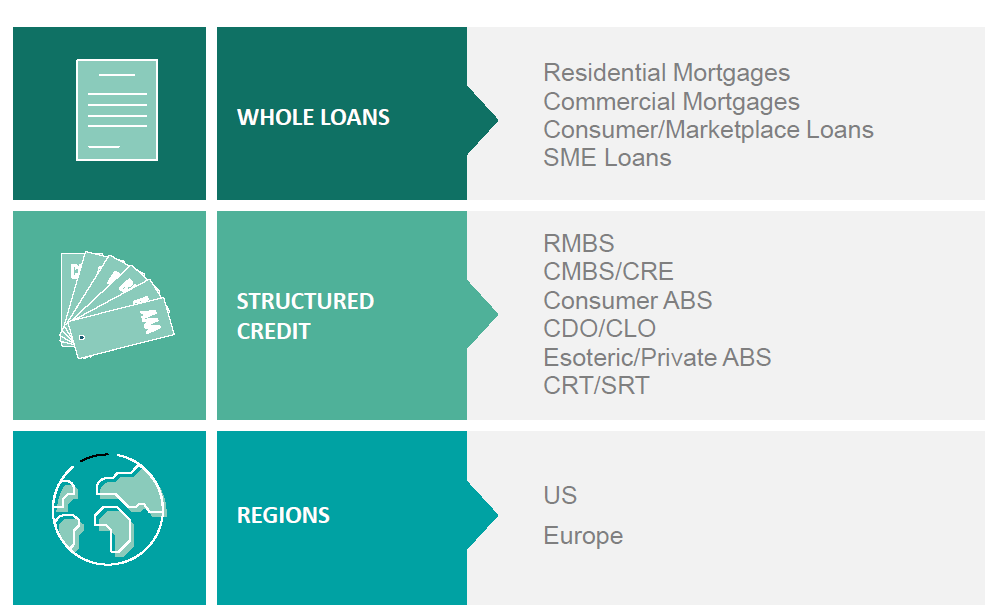

LoanClear provides valuation services for illiquid portfolios, specifically catering to the alternative fixed income investment community. With extensive industry experience, we have collaborated closely with leading investors in alternative assets. Our expertise lies in delivering accurate and reliable valuation services across a diverse range of illiquid credit assets. Our expert team employs audited methodologies to ensure compliance with market standards. Whether offering monthly valuations for financial reporting or tailored advisory services, we cover a wide array of assets.

Structured credit, corporate credit and loan portfolio valuation

- Utilizing advanced analytical techniques to evaluate risk and determine fair value across asset classes.

- Tailored valuation approaches for each asset class, ensuring a nuanced understanding of portfolio performance and risk exposure.

Model and methodology validation

- Rigorous examination and validation of valuation models and methodologies specific to ABS, CMBS, CLO, CRT/SRT and other asset classes.

- Incorporation of industry best practices and regulatory standards tailored to each asset class, ensuring compliance and credibility.

- Continuous refinement and improvement of models to adapt to evolving market dynamics and client needs across all covered asset classes.

Scenario analysis, sensitivity analysis and stress testing

- Robust scenario analysis to simulate diverse market conditions and assess their impact on portfolio performance, spanning ABS, CMBS, CLO, CRT/SRT and more.

- Detailed sensitivity analysis across all asset classes to identify key risk factors and their influence on valuation outcomes.

- Stresstesting methodologies aligned with regulatory requirements for ABS, CMBS, CLOs, Mortgages and other covered asset classes, providing insights into portfolio resilience under adverse scenarios.